Written by Clara Hori

Written by Clara Horion December 01, 2022

The onboarding phase of a consumer journey is important because it sets the tone for the future relationship. This initial onboarding period welcomes new consumers into your financial institution and provides them with the relevant information they need to get started.

Despite this, the Financial Brand1 found that only a little over 50% of banks and credit unions have a structured onboarding program. If someone opens an account with your FI, it doesn’t mean they’re going to stay, so it’s essential to nurture your relationship and provide a frictionless welcoming process. Below you’ll find tactical strategies to make a great onboarding campaign.

Personalize the Experience

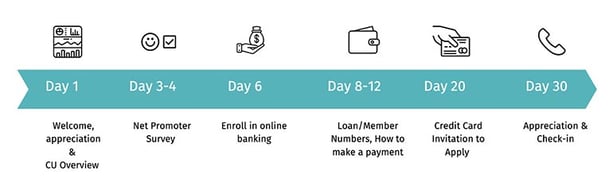

Every consumer has a different set of financial needs. The first 90 days (and the following few months) are critical in forming a solid foundation. A great onboarding campaign goes beyond a simple “Thank you for opening an account!” message, and consumers should receive consistent communication to ensure the process goes smoothly.

Onboarding campaigns should provide general information on setting up online banking, direct deposit, communication preferences, and other tasks that will help people get acquainted with your FI. To go the extra mile, you can create onboarding activities such as webinars or Q&A videos that serve as additional educational content.

Create a Seamless Digital Experience

In Prisma’s savvy scenarios series, we focus on how to improve the onboarding process, and we shed light on how to enhance the digital experience. Customers expect seamless digital experiences, and investing in quality onboarding software may help your team deliver on these high expectations. If someone has to repeatedly contact your call center, fill out paperwork, or visit your branch, this leaves a poor impression of starting a relationship with your FI.

For a better experience, any online applications or forms should be as intuitive as possible. This can mean fewer pop-ups or links taking people away from the original page. If someone has to exit their application, it should be just as easy to log back in. It may be worthwhile to add newer features such as auto-fill or secure identity verification to simplify and speed up the process.

Check In Consistently

Each touchpoint will help you shape a more holistic view of your consumer while making sure they are receiving the best possible customer experience that fits their needs. To supplement these communications, your team should be trained on the onboarding process, so that everyone is on the same page and can be helpful resources.

To make sure your process is going smoothly, check in! You don’t need to bombard your consumers with messages and emails, but you can extend a helping hand in case they have any questions. This also creates a dialogue that encourages questions and honest feedback for future improvements to the process. Any time that you can gather information and direct responses from your consumer is beneficial.

Prisma helps financial institutions improve their onboarding process and avoid common mistakes such as generic messaging or poor coordination through high-performing omnichannel campaigns. As your relationship grows and you learn more about your new consumers, you can also add more personalized components to your campaigns, test new messaging channels and segment consumers based on their preferences and patterns.

To form a great first impression that lasts, learn what Prisma’s marketing automation software can do for your financial institution, and visit Prisma’s blog posts for more useful marketing tips and strategies.

(1) The Keys to Successful Digital Onboarding for Banks

Image credit: Adobe Stock