Written by Clara Hori

Written by Clara Horion November 04, 2020

The pandemic has credit union marketers struggling to digitize at breakneck speed. Here are five challenges standing in their way.

Challenge 1: is digital-first a fit for your credit union?

Before the pandemic, credit unions had already grown to consider digital marketing important. But because of their success reaching their potential customer base via offline methods, they had a tendency to see digital only being truly necessary if they were actively trying to appeal to millennials and Gen Z—a consideration that has recently become relevant, due to an aging membership base (according to CUInsight, the average age of a credit union member is 47, meaning they are past their prime borrowing years).

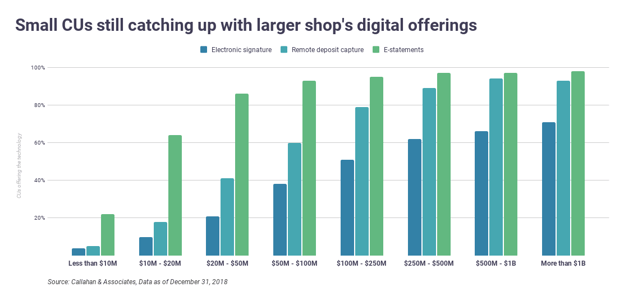

Pre-COVID, many credit unions had a plan to “come into their own” digitally. Maybe mastering the world of digital marketing wasn't being consciously postponed, but the fact is that year after year, credit unions were not making as much progress as consultants and advisors urged them to. This lack of compelling reason around implementing a solid digital marketing strategy, paired with the difficulty of coming up with a way to translate a great reputation for personal services into a digital format, could explain why credit unions have been slower in terms of digital adoption than larger financial institutions and, in certain respects, other industries.

The pandemic was a wake-up call. Credit unions realized how vulnerable they were without ways to reach prospective customers outside of their physical branches (which have seen traffic drastically reduced due to lockdown conditions imposed in many locations). And the challenges faced by credit unions today as they look to actively embrace digital marketing as quickly as possible are multifaceted.

Challenge 2: Not enough familiarity and relationships with digital vendors

Credit unions and community banks tend to be focused on traditional marketing channels. Communications were typically very much dependent on print media/advertising, direct mail, and in-branch promotions, so that’s what most marketing agencies serving credit unions have been focused on. In this context, the role of marketing managers working with credit unions has been more tactical than strategic, with the agency providing services to meet very specific, non-digital needs.

Digital advertising, social presence and social proof, SEO, inbound marketing, lead generation, lead nurturing and conversion, are not new for credit union marketers. But they were usually a smaller part of their strategy. To accelerate the learning curve here, working with agencies and technology vendors that have expertise in these areas is going to be critical.

Challenge 3: Combining speed, convenience and a personal touch requires digital mastery

"We want to deliver fast and convenient AND offer the personal touch we are known for without standing in the way," said Ann Jones, VP of Marketing & Business Development for Michigan Schools and Government Credit Union. "The heart and soul of who we are has to come through our digital channels as well".

Historically, credit union members have been very much focused on in-branch connections. It can be difficult for even the most talented marketing firm to find ways to capture this ethos of human interaction in a digital campaign. For example, a large credit union in Colorado shared that when they closed their lobby due to COVID, they started having a long line at their drive-thru. Credit union staff were trying to encourage customers lining up at the drive-thru to use the ATM for self-service, but people just wanted to check in on their usual teller and see how they were doing with COVID. Some people (those same people who withdraw money as part of their daily routine) were just talking out $5 for that human touchpoint they were so accustomed to!

What this suggests is that the bar is high for digital. It's not enough to be convenient and fast. In the long run, members expect the experience to be also personal, relevant and pleasant.

Challenge 4: Re-evaluating marketing spend is needed in order to increase digital

Because branch traffic has dropped so significantly, customer touchpoints have shifted. Members typically now arrive at their credit unions on an appointment basis, ask for a medallion certificate or access to their safety deposit box, and then leave as quickly as possible, to limit the possibility of coming into contact with COVID-19. This means there is now little value in displaying in-branch pamphlets and signage.

Marketing spend has therefore had to be completely re-evaluated, and re-weighted, by credit unions. To put this into context, one credit union in Tennessee recently reported spending $14M on branch infrastructure throughout their entire network, only to find that once the pandemic hit, they were only seeing an average of 350 customers per month show up in-branch. Their CEO jokes that it would have been cheaper to pay for everybody to take an Uber to the branch to do their banking than continue to pay these in-branch costs.

Challenge 5: Data maturity is needed to cater to different needs

Since COVID, we’ve been seeing that the credit unions that are able to tap member data to identify who needs what are making better use of their resources. For example, not all members wanted and needed skip-a-payment, and offering it widely isn’t good for the business. Some members do not want to postpone their next financial milestone, like a first home or a new car. And many members will accept a well-placed offer to refinance, either because they can use the cash back, or simply because it makes sense to do so. The value of data has never been so clear when member's needs are so distinct as they are now.

Credit unions have the data needed to segment their members into different audiences, but that's easier said than done. Accessing that data and using it is complex and CUs lacking data maturity can save themselves a lot of time and trouble by partnering with specialized vendors from whom they can learn shortcuts and best practices.

In summary

Those CUs that hadn’t yet prioritized digital marketing when the pandemic began quickly found that they were not in a position to attract young people simply by virtue of the existence of branches. A study conducted by Adobe Analytics for CNN Business showed that while Gen Z still likes branches, they’re not essential anymore and this may continue beyond COVID-19. Younger people like branches and their perks, but they certainly don't depend on them and aren’t willing to relinquish their digital expectations in exchange for an in-branch lobby doughnut. In the absence of attention-grabbing digital campaigns advertising the benefits of CUs, the sons and daughters of credit union members are going to the more trendy banks: the ones that have a solid digital footprint.

Credit unions have had to put their lack of familiarity with the web and mobile world aside as they plunge into the uncharted waters of digital marketing. Some have struggled to find ways to pivot their marketing efforts in such a significant way, while others have succeeded in bringing onboard creative thinkers who can spearhead these initiatives with confidence. But either way, having a digitally-savvy agency on their team can make a huge difference in their ability to implement these changes.

This two-part blog post series is based on stories that we’ve heard from our credit union clients and our marketing agency partners, as well as through observing industry trends. In part two, we’ll talk about a digital way forward. We’ll discuss evolving attitudes around digital, and how leading agencies are levelling up to help their credit union clients expand their membership reach and compete against the services and digital experiences of community and bigger banks.

Image credit: Prisma Campaigns; data from Callahan & Associates

Image credit: Unsplash