Written by Felipe Gil

Written by Felipe Gilon August 24, 2021

All good leaders possess a few common traits. Some of these ubiquitous qualities include confidence, communication skills, integrity, and a vision for improvement. At Prisma, we believe that great leadership is reflected through the team that you build and the way in which you empower them to become better leaders themselves.

An effective leader should trust and delegate to the people they manage. A mutual sense of trust and respect creates a shared outlook of success for an organization’s future. Where there is effective leadership, there is an efficient team.

Building An Effective Marketing Team In Uncertain Times

The marketing industry evolves every day, and we are constantly adapting to modern tools, trends, and technology. The pandemic only accelerated many of the marketing trends we’ve discussed over the last five years: a more digital customer and membership base, a reduction in branch traffic, and a stronger need for effective digital selling. Building a team that helps you deliver on these new digital promises is no small task.

The COVID-19 pandemic taught many leaders that mentoring a team during unusual times is difficult, but it also highlighted the developmental process of learning alongside your team. The banks and credit unions that successfully navigated the early pandemic deliberately supported their employees and empathized with customers and members through genuine actions. An important takeaway is that successful marketing is not solely based on campaign performance, but on fulfilling your customers’ needs while creating company value and maintaining a favorable work environment for your team.

Throughout the past year, we learned that preparation and planning only get you so far, but it is encouraging to see that creative breakthroughs and major growth can happen during unexpected and difficult times. We know that one person doesn’t have all the answers to being the best financial marketer. However, creative management welcomes new ideas and encourages an innovative environment.

An effective leader leaves room for honest discussion, and the voice of every team member is considered, valued, and heard. This leadership style is more likely to make your team feel comfortable approaching you with questions, concerns, and constructive feedback. Leaders can gauge what works and what doesn’t for an effective workplace if they have diverse perspectives and candid check-ins with their employees.

Leading Digital Change Across Your Organization

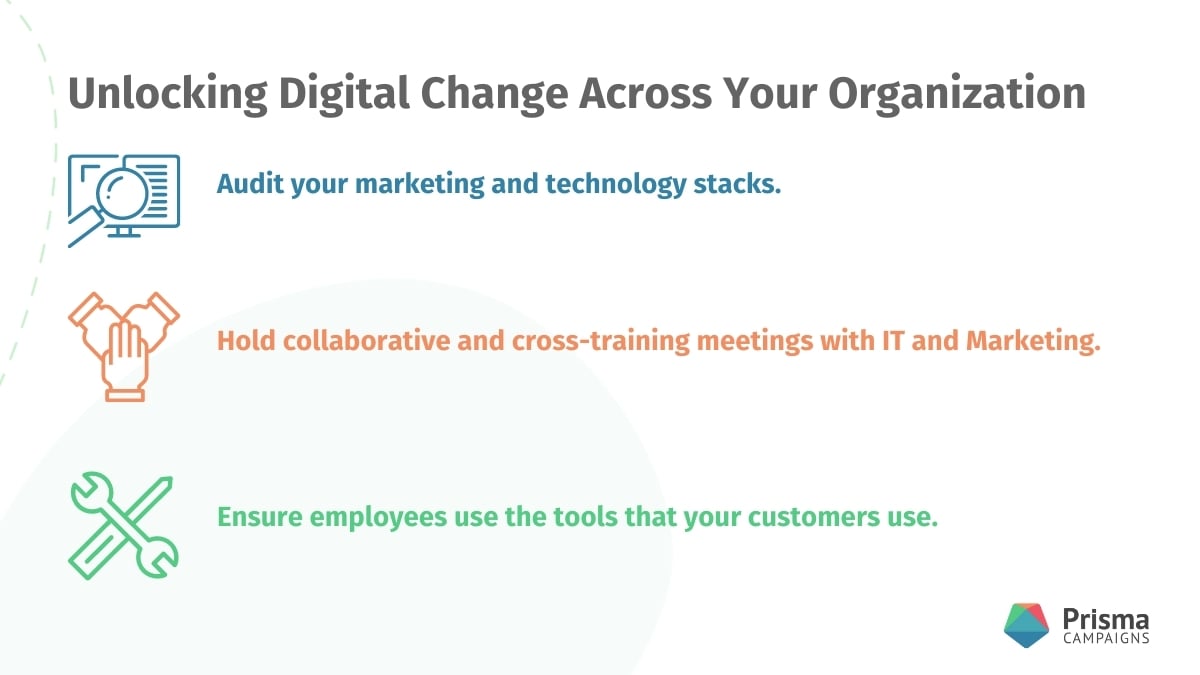

The past year necessitated a high-quality digital marketing and customer experience. Organizations, along with their employees and customers, interacted less in person and grew accustomed to conducting business online. We’ve seen the banks and credit unions who invested in their technology, data, and analytics more smoothly transition to this new normal. As a marketing leader at your financial institution, it’s important to investigate how these modern systems could benefit and grow your business. Here are three quick tips to unlock digital change across your organization:

- Audit your marketing and technology stacks. Take a hard look at what systems you use effectively, what services you use sparingly, and what tools are driving actual customer benefits and outcomes.

- Hold collaborative and cross-training meetings with IT and Marketing. Marketing and technology are more intertwined than ever before. CIOs and CMOs should not only communicate regularly, but also train their teams in their respective language and process.

- Ensure employees use the tools that your customers use. It may sound simple, but ensuring your team members use the services that your customers use each day will help you discover and address any customer experience missteps.

As you reflect on the agility and effectiveness of your marketing efforts this past year, how do you ensure that you take important lessons and apply a digital-first mindset to your immediate team and greater organization?

Look Back And Lean Forward

Digital-first customers and members at banks and credit unions are here to stay, and it’s important for financial organizations to have strong interactions with their customers through all digital channels. It should not matter if a user is consuming content through the website, email, SMS, or interacting with your organization in person. At Prisma, we believe that financial institutions should provide cohesive content on all channels to give their customers and members a seamless user experience. More people are interacting with their financial institutions online, and there is an intensifying pressure to create powerful marketing for banks and credit unions. There are countless options to advance your digital presence, but we see automation, personalization, and consistent messaging on all channels as tried and true ways to stay ahead in a competitive marketing environment.

We expect financial leaders to possess certain character traits and behaviors, but effective leadership boils down to the success and satisfaction of your team. Powerful leadership involves being open to new ideas, but accepting accountability if an opportunity is met with roadblocks or failure.

Financial marketers face a constant influx of marketing and technology options. There will always be a new upgrade, a more modern data tool, or another trendy marketing software. As a leader, how you audit and address the connectedness and performance of these systems will set you apart in a new generation of digital-first leadership.

Image credit: Adobe Stock