Written by Allie Aitken

Written by Allie Aitkenon February 03, 2021

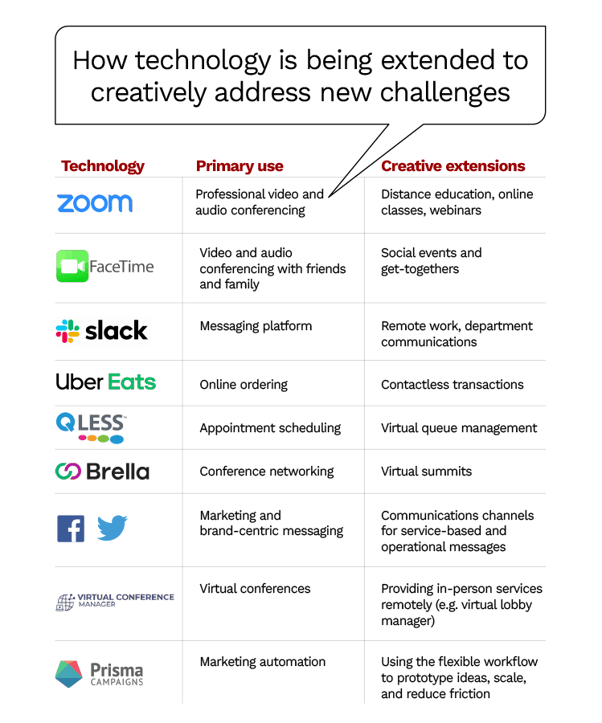

In a recent article published in leading industry publication The Financial Brand, our CEO Felipe Gil, shares his thoughts on making the most of technology by extending its capabilities to adapt in challenging times.

He points out that the pandemic didn’t necessarily push businesses and consumers to new tools. Many of them already had flexible solutions at their fingertips, it was just a question of shifting their mindset...

A need for fast and flexible innovation

Gil opens the article with comments on the past decade's technological advancements, how FIs are adapting to the new normal, and the importance of agility and creative thinking as banks and credit unions remake their customer experience in response to the pandemic.

“Banks and credit unions often look to technology upgrades to keep pace,” said Gil. “In an ideal situation, a bank identifies its requirements, approves a budget, and issues an RFP to select the best solution. But in a fast-paced and complex environment, few can afford to go through a full procurement process for new solutions.”

As unpredictable times call for flexibility and innovation, many banks and credit unions have learned that having a flexible tech stack offers tools and solutions to address new challenges.

Creative ways FIs are extending technology

With specific examples from our clients including SIU Credit Union, Numerica Credit Union, The Credit Union of Colorado, and Banco Agrario de Colombia, Gil explores how industry-agnostic technologies are being extended to creatively address new challenges, and how a tool like Prisma Campaigns enables financial institutions to innovate at a fintech-level pace.

“The flexibility of Prisma Campaigns helped many banks and credit unions save time and money by negating the need for entirely new solutions,” continued Gil. “In a time of rapid change and an uncertain future, flexible solutions can offer assurance and options to overcome whatever challenges may arise.”

Read the full article on The Financial Brand.

Image credits: Adobe Stock and The Financial Brand