We are living in a digital world

In 1985 Madonna released her hit “Material World” and people around the world danced to the song and sung that “we were living in a material world.” Neither Madonna, nor anybody at the time could have imagined the changes that were to come. Thanks to the internet we are rapidly moving away from onsite infrastructure, the world is becoming more and more social and mobile every day, and people today often prefer to scroll than to walk up to a store. Technology is present in every aspect of our daily lives, from the way we communicate, we work, we travel to the way we buy. We could very well agree that an update for Madonna's lyrics is due and sing that “we are living in a digital world”.

Technology has also had a huge impact on customer expectations. If there was a time when customers wanted to acquire a certain good or service, today they also want to have the feeling of being a part of something important or chic while they do it. For a company to fulfill that expectation has become a source of difference and value against competitors.

In the case of banking, and retail banks in particular, setting a brand apart rarely relies on services, since most of them provide the same ones: daily-use accounts, savings accounts, payment cards, various loan and credit options, and investment services. What customers expect from banks today is the option to do anything and everything related to their accounts, money, and data from everywhere.

The origin of this phenomenon, which’s not exclusive of financial institutions, can be traced to the early 2000s when online customer relationship management (CRM) appeared for the first time, and continued to grow by stages facilitating for any business to access enterprise quality sales automation software, increasing their competitivity no matter how small or big the business was. It may have been hard at the time to realize the profound impact this would have, along with the quick improvement and spreading of application programming interfaces (APIs) that facilitated the birth of SaaS (software-as-a-service). Today they rule the game: we live in an “APIs economy”.

New solutions for new client expectations in financial services

New solutions for new client expectations in financial services

Consumer expectations today are to be known, to be reached and to be rewarded. This implies, whether we want it or not, a huge challenge for the marketing department. It is just one of the multiple and simultaneous paradigm shifts that banks are facing, but it is a crucial one.

Marketers have the complex task of engaging with customers across the web, email, social media, online and offline events, mobile devices, and so many other channels! And they have to do it in real time while keeping up with a demanding pace. They should also be able to transform those interactions into actual sales.

The success of multi-channel marketing efforts relies on having the information and interpreting it right, the quicker this can be done, the quicker marketers can know if the strategy chosen is working or if it needs some adjustment. In this sense automation platforms have essentially introduced to marketing a previously unseen level of flexibility that makes it easier for marketers to cope with huge amounts of data and analytic insights.

So far we have customers with new high expectations, and a tough list of tasks to achieve for marketers, but also a whole new sector of software born to help marketers nurture leads from their first contact with a company to the point of sale. And the good news is that this new field of software development dedicated to marketing automation solutions is growing and spreading, creating a market scenario were multiple and diverse options emerge from where to choose the perfect one for your financial institution.

The challenge: transitioning from one paradigm to another

It is a widespread opinion that the current state of financial services marketing is overwhelming, there is no longer a definitive model for effective marketing and today financial marketers can choose from multiple software and services providers. Also, the environment in which they operate is constantly changing with new channels and emerging technologies.

But in this overwhelming situation, can you imagine if your company could streamline, automate, and measure marketing tasks and workflows? Can you imagine if predictions, email campaigns, social media platforms, customer retention programs, etc. could all be automated? Can you imagine being able to track the success of particular campaigns in terms of clicks and conversions?

Well, this is simply everything that marketing automation does. Actually, it's difficult to even imagine how to achieve all those tasks (and how to process the amount of data that they necessarily implicate) without an automation platform! So why not take the challenge?

There shouldn't be a real impediment for marketing in financial institutions to embrace new software dedicated to marketing automation solutions and get the benefits of it, but unfortunately, the available information shows that there are two main outcomes for most bank marketers, neither of which is very optimistic:

- To remain stuck in the past using the same outdated data sources and worn out marketing methodologies turning a blind eye to new affordable and powerful tools available to create a powerful omnichannel customer experience.

- To dispose of the right tools but remain unable to use them in an effective way.

Adopting a digital marketing tactic requires new skills and capabilities that many times are not properly understood or implemented. In most cases, the resistance from financial institutions to take the challenge of adopting digital marketing tactics comes from the lack of experience with new platforms

It is also a widespread opinion that financial institution has been always reticent to change:

“Roughly one in four organizations (24%) currently use some form of marketing automation, with another 29% indicating that they plan to use marketing automation software in the future. The percentage with ‘plans to’ implement marketing automation in the next 12-18 months increased by 8% since 2017. Of concern is the fact that 42% of organizations do not leverage marketing automation (and don’t plan to in the near future).” (Digital Banking Report, 2018 Guide for Financial Marketing)

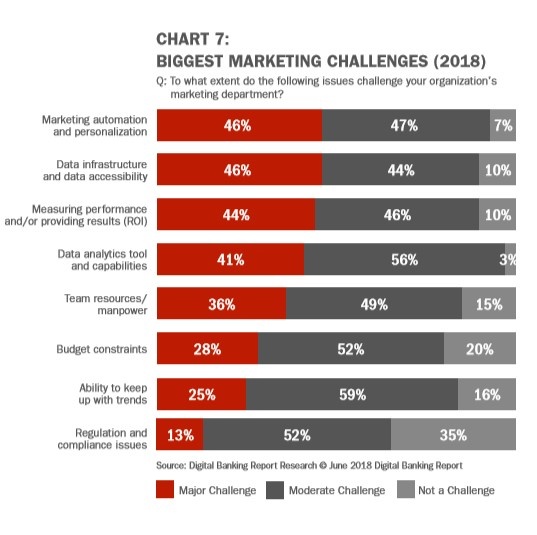

It is always challenging to transition from one paradigm to a new one. That same report points out that “responders to [the] 2018 Guide to Financial Marketing study indicated that the ability to personalize communication with automation and the accessibility of data were the biggest marketing challenges, with 46% of respondents seeing these as a major challenge” (Figure 2)

The ability to personalize communications with automation tools and the accessibility of data might be the biggest marketing challenges because of the paradox created by personalization between improving customer experience and trust. Use, sharing and protection of individual’s data is a very sensitive issue, as this information is needed to optimize the customer journey as is expected, it must also be transparent at all instances and accurate according to privacy regulations. This is a delicate task, but not impossible, and highly rewarding in terms of ROI improvement for every financial institution that is taking the challenge.

Technology has reshaped the world in which we live and is forcing us to reshape the ways in which we think and do things. It brought a bit of chaos but it also brought many solutions. If we take a look at the benefits of marketing automation:

- it increases operational efficiency,

- it makes it possible to gain an enhanced level of understanding, control, and effectiveness over every marketing campaign,

- it filters out the poorly performing content to maximize positive response rates from customers.

Automation tools are just the kind of technology that can really give you a hand. It’s only a matter of getting the right information and designing a strategy to pursue and you’ll be ready to take the challenge to improve.

Make a strategy

Once the decision of looking for a marketing automation solution for your financial service is taken, many options arise. But before jumping into the wondrous world of automation platforms for financial marketing, in order to know what to look for, what to avoid, what priorities to set, you might first want to:

- Carry out a systematic maturity assessment of the market, it's important to know what’s your place in the full picture. Map your own capabilities to current industry expectations.

- Then, it would be of extraordinary value, to do a self-analysis, identifying the areas in your marketing department that need immediate attention and those that can wait.

Give some time to the process, it’s better to look for an automation platform with a clear idea of what is working and what needs to be fixed, and the technologies that need to be in place to make it all work.

Some considerations

Marketing automation software will surely help with email automation, but it can also track your campaigns, lead management and streamline and organize workflow. After all, it was made to help in your digital marketing efforts. Below is a look at some considerations to help you make sure that the automation platform you choose isn’t more trouble than it’s worth.

Stacks vs. Best-of-Breeds

Maybe the first thing you should consider before going shopping for an automation platform is that there are two kinds of these products in the software market:

- “Stacks” are the ones that are usually sold by large vendors with all-in-one suites. This kind of software used to rule the market, but due to technology improvements in integration are losing ground. They tend not to be able to keep with the pace of technology innovation.

- “Best-of-breed” are usually sold by small and more innovative vendors, and are the ones gaining ground to “stacks”. One of the good things about “best-of-breeds” is that each department can choose their own, the one that fits them better. Today, even when they use cutting edge technology they are no longer difficult to integrate with other systems and to upgrade, and can be considered a mature option since they are now viable products and services.

Marketing Automation Features

The following is a list of the marketing automation features that every platform should have to be worth considering

- Analytics/ROI Tracking

- Drip Campaigns

- Landing Pages/Web Forms

- Segmentation

- Social Marketing

Marketing Automation Basic Tasks

While you compare them side-by-side, keep in handy the following list of tasks. It might help you to have a better idea of what things a desirable automation platform should be able to accomplish.

- Upload a list of contacts

- Create a segment

- Create a landing page/web form

- Create an email template

- Create a drip campaign

- Generate a report

User-Friendly Marketing Automation

While considering an automation platform check how their usability, customer service and customer reviews fare and you will be able to measure how user-friendly it is. Below you’ll find what to check for each item.

USABILITY

- Task completion time

- Clicks to complete task

- System Usability Score (SUS)*

* SUS - a questionnaire that measures perceived ease of use.

CUSTOMER SERVICE

- Implementation (# of configuration options offered)

- Training (# of resources offered)

- Support (# of services offered)

REVIEWS

- Ease of Use

- Customer Service

There are other criteria that could be analyzed in depth and taken into consideration like affordability or popularity of a marketing automation platform for financial services, but since an automation platform is meant to ease the marketers job, not to make it more complicated, to look for the most user-friendly automation platform affordable for your company still seems to be the best option to get you on board of automation marketing and get the best of it.

Some valuable tips

Taking the following general tips into account might help to set some parameters in the search of a marketing automation solution, that will hopefully make things easier for your colleagues working in the marketing department and improve your ROI:

- An automation platform it’s supposed to save you time and resources. The software you choose should be easy and intuitive to use, one that involves repeatable and streamlined actions (one that can clone existing programs, edit in one place and automatically upload the underlying assets). Pick a system that isn’t more trouble than it’s worth it, be suspicious if your system wants you to copy-paste.

- Avoid any software that sends batch-and-blast emails to generic audiences, nobody reads or responds to those emails anymore. Desirable software should make it easy to have a conversation with your client, to listen and respond on all channels and keep track of what messages customers have already seen. It should enable you to gently walk the client to the sales funnel.

- Look for a solution that lights your creativity. With a complete, varied, library of resources, always updated. For example, email and landing page templates are always welcome.

- You want software that’s responsive to your growth, that “learns” with you. Once a marketing automation program walks you through a step-by-step process, you want to be sure that there would be no need to do it again.

- A good automation platform shouldn't get old quickly. It's important to be aware of the actual state of marketing, knowing that it is constantly changing and it will continue to do so. Choose an automation platform that shows signs of being flexible and adaptable. Maybe even one that looks futuristic.

- There's no need to do this alone, search for community and avoid isolated, hermetic solutions. Make sure that your new automation software gives you access to a supportive community, changing from one paradigm to a new one is not easy and you might need the help of expert colleagues along the way.

- Don't be afraid of asking too many questions. Some software designs might look smart enough to help with a problem, but if you look closely at the functionality you can discover they aren't, and you want to discover this before acquiring the software. The solution you are looking for is meant to optimize your time and energy, especially when it comes to reporting and analytics, this should be user-friendly and flexible.

The whole point of getting an automation platform for marketing is to be able to accurately prove the ROI of your marketing campaigns.

Great challenges come with great opportunities

Great challenges come with great opportunities

According to IDC “an Accenture survey released early last year, one in three people would happily switch their bank accounts to Facebook, Google, or Amazon if they started offering banking services". Luckily, we are not that close to see this actually happening but this is valuable information, and maybe should be taken as a warning. What the survey is screaming in our face is that what customers really want from their financial institution is to be provided by better real time, personalized and contextual interactions.

This is indeed a great challenge, and we couldn't agree more that “The current state of financial services marketing is both ‘the best of times and the worst of times,’ where being a marketer has never been more exciting", according to the Digital Banking Report, 2018 Guide for Financial Marketing.

[[ You may also want to read this if your company is a Credit Union ]]

But remember that great challenges come with great opportunities, embracing new data sources, technologies like automation platforms and digital marketing channels will provide your clients with better real-time, personalized and contextual interactions.

These are the things that add up to a better customer experience. And marketing today is all about the customer experience.